Fibonacci retracement and extension tools are popular indicators traders use to identify potential support and resistance levels in financial markets. These indicators are based on the Fibonacci sequence, a sequence of numbers where each is the sum of the two preceding numbers (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, etc.).

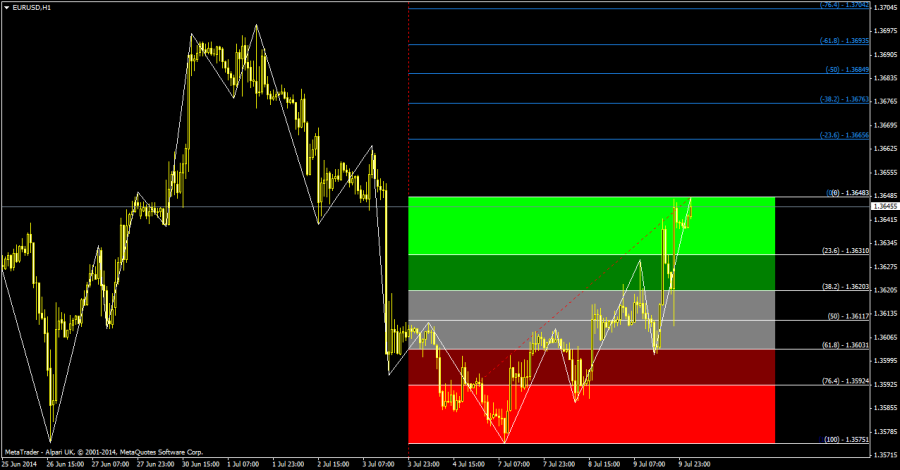

The Fibonacci retracement tool is used to identify potential support and resistance levels by drawing horizontal lines at the key Fibonacci levels of 23.6%, 38.2%, 50%, 61.8%, and 100%. Traders use these levels to identify potential entry and exit points.

The Fibonacci extension tool is used to identify potential price targets beyond the current trend. This indicator plots horizontal lines at the key Fibonacci levels of 161.8%, 261.8%, 423.6%, and 685.4%.

Both indicators are available in the MT4 platform and can be easily added to charts. To access these indicators, click the “Insert” menu at the platform’s top and select “Fibonacci.” You can choose the retracement or extension tool and customize the levels.

It’s important to note that while these indicators can be useful in identifying potential trading opportunities. They should be used in conjunction with other technical analysis tools and should not be relied on as the sole basis for trading decisions. Additionally, past performance does not necessarily indicate future results. So it’s important to always practice proper risk management techniques when trading.

Top 5 Fibonacci Indicators for MT4

Here are five commonly used Fibonacci indicators in MT4:

- Fibonacci retracement tool: This indicator is used to identify potential support and resistance levels in a price trend. Traders use these levels to determine potential entry and exit points.

- Fibonacci extension tool: This indicator is used to identify potential price targets beyond the current trend. Traders use these levels to determine potential profit targets.

- Fibonacci arcs: This indicator is used to identify potential areas of support and resistance in a price trend. The arcs are plotted based on key Fibonacci levels and can help traders identify potential reversal points.

- Fibonacci fans: This indicator is used to identify potential areas of support and resistance in a price trend. The fans are plotted based on key Fibonacci levels and can help traders identify potential trend lines.

- Fibonacci time zones: This indicator is used to identify potential areas of support and resistance in a price trend base on time. The zones are plotted base on key Fibonacci levels and can help traders identify potential trend reversals base on time.

Again, it’s important to note that while these indicators can be useful in identifying potential trading opportunities. They should be used in conjunction with other technical analysis tools and should not be relied on as the basis for trading decisions. Additionally, past performance does not necessarily indicate future results. So it’s important to always practice proper risk management techniques when trading.